Next: TAC

Up: General Approach

Previous: The Full Approach

Consider a camera and a flash with interacting values to an agent as

shown in Table 2. Further, consider that the agent

estimates that the camera will sell for $40 with probability 25%,

$70 with probability 50%, and $95 with probability 25%. Consider the

question of what the agent should bid for the flash (in auction

). The decision pertaining to the camera would be made via a

similar analysis.

). The decision pertaining to the camera would be made via a

similar analysis.

Table 2:

The table of values for all combination of camera and flash

in our example.

| |

utility |

| camera alone |

$50 |

| flash alone |

10 |

| both |

100 |

| neither |

0 |

|

First, the agent samples from the distribution of possible camera

prices. When the price of the camera (sold in auction  ) is $70

in the sample:

) is $70

in the sample:

-

-

is the best set of purchases the agent

can make with the flash, and assuming the camera costs $70. In this

case, the only two options are buying the camera or not. Buying the

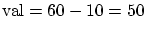

camera yields a profit of

is the best set of purchases the agent

can make with the flash, and assuming the camera costs $70. In this

case, the only two options are buying the camera or not. Buying the

camera yields a profit of  . Not buying the

camera yields a profit of

. Not buying the

camera yields a profit of  . Thus,

. Thus,  , and

, and

![$[v(G_w+H) - G_w \cdot Y] = v(1,1) - (0,1) \cdot (\infty,70) = 100 - 70$](img72.png) .

.

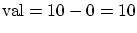

- Similarly

(since if the flash is not owned, buying

the camera yields a profit of

(since if the flash is not owned, buying

the camera yields a profit of  , and not buying it

yields a profit of

, and not buying it

yields a profit of  ) and

) and

![$[v(G+H) - G \cdot Y] = 0$](img76.png) .

.

-

.

.

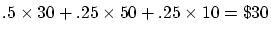

Similarly, when the camera is predicted to cost $40,

; and when the camera is predicted to cost

$95,

; and when the camera is predicted to cost

$95,

. Thus, we expect that 50% of the

camera price samples will suggest a flash value of $30, while 25%

will lead to a value of $50 and the other 25% will lead to a value

of $10. Thus, the agent will bid

. Thus, we expect that 50% of the

camera price samples will suggest a flash value of $30, while 25%

will lead to a value of $50 and the other 25% will lead to a value

of $10. Thus, the agent will bid

for the flash.

for the flash.

Notice that in this analysis of what to bid for the flash, the actual

closing price of the flash is irrelevant. The proper bid depends only

on the predicted price of the camera. To determine the proper bid for

the camera, a similar analysis would be done using the predicted price

distribution of the flash.

Next: TAC

Up: General Approach

Previous: The Full Approach

Peter Stone

2003-09-24

![]() ). The decision pertaining to the camera would be made via a

similar analysis.

). The decision pertaining to the camera would be made via a

similar analysis.

![]() ) is $70

in the sample:

) is $70

in the sample: